Resources & Downloads

Autorizacion Buro de Credito Ingles (EN blanco) para spl usd

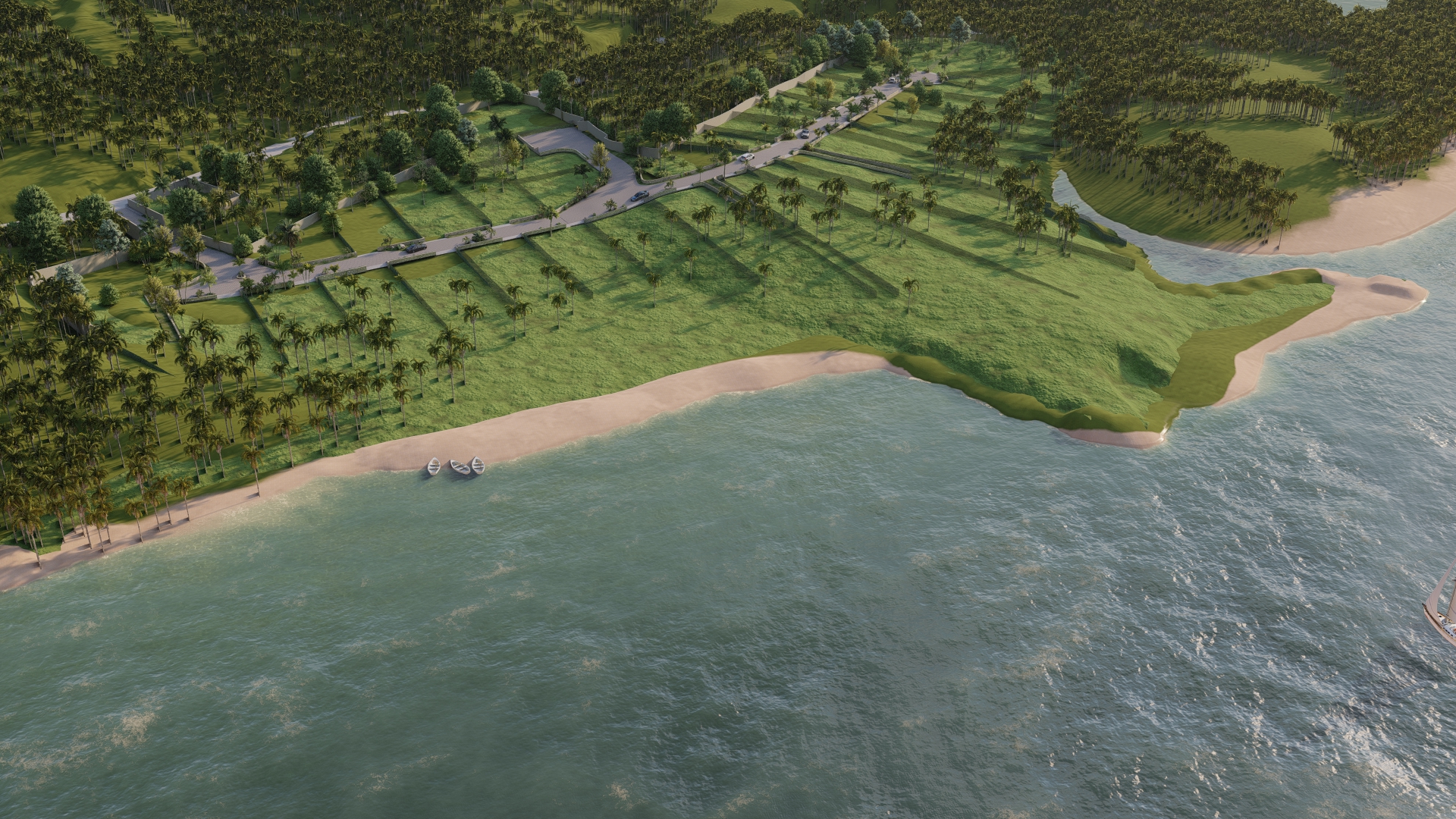

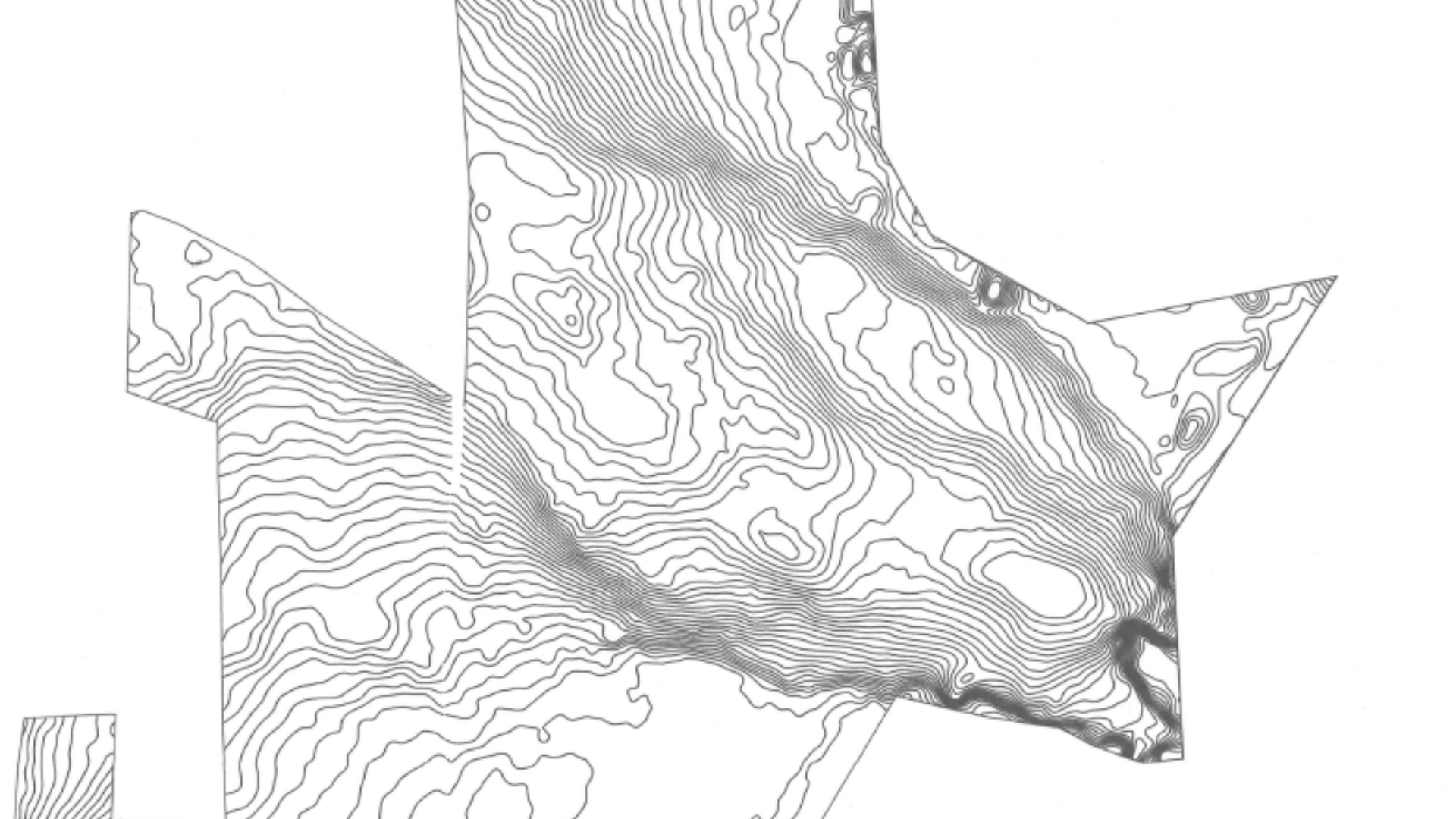

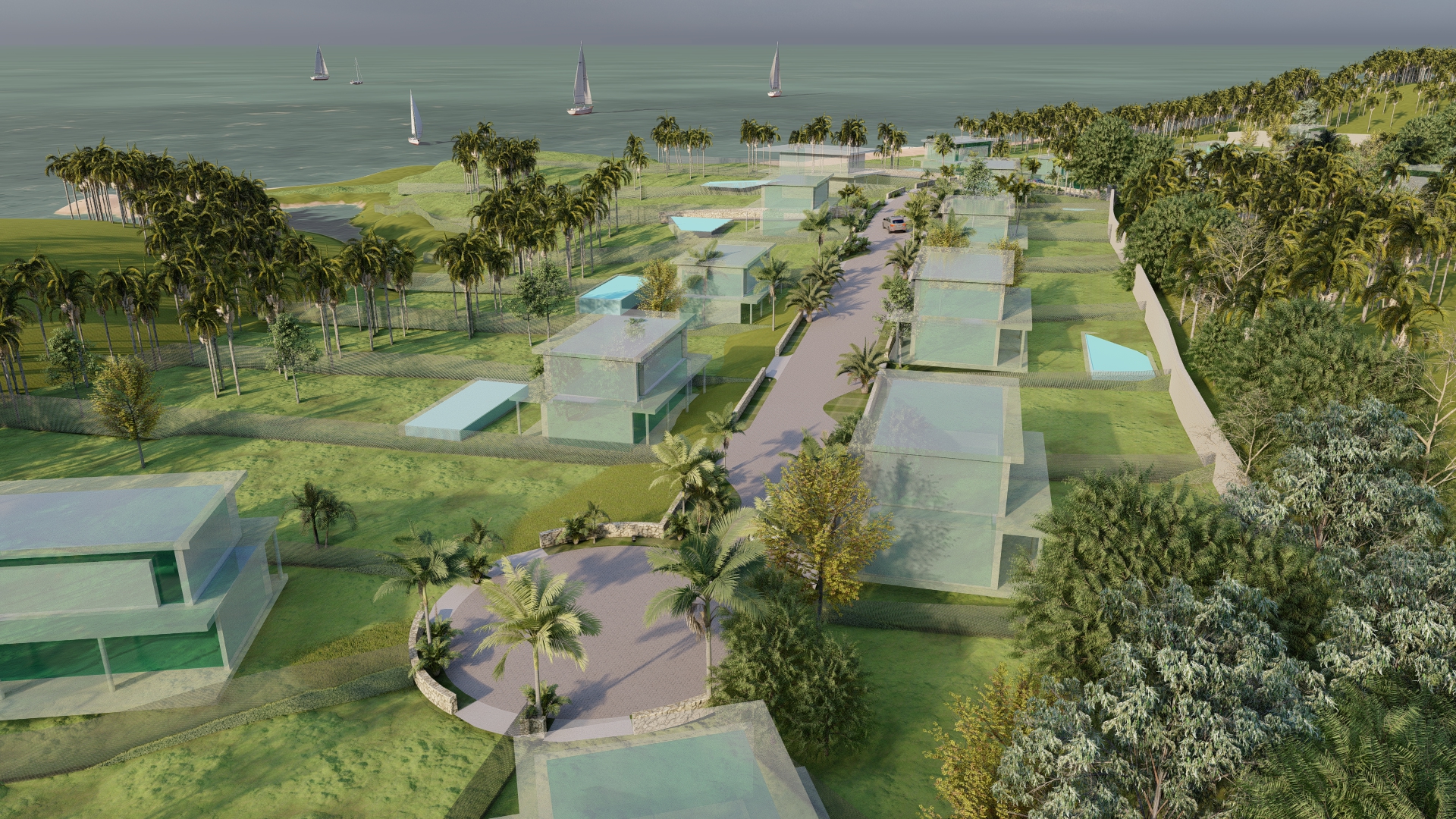

LOTEO 1.500 (sq ft)

Sold Lots

Financing options

NON RESIDENT VACATION HOME PROGRAM

KEY CHARACTERISTICS FOR RESIDENTIAL MORTGAGES

(FINISHED PROPERTIES)

- Excellent Interest Rate. 8.25% to 9.0%.

- Competitive legal expenses. We only charge the legal expenses of the

- Operation, such as Mortgage Registration Tax and Property Transfer Tax.

- Personalized services

- financing of one property per customer.

- The property to buy must be included in one our authorized projects.

- Title deeds must be transfer in the personal name of customer.

- financing available to U.S., Canadian, and UK residents only.

- Residents from other countries will be considered by the approval

Department strictly on an exception basis.

- Loan amount to be in USD currency only.

- Up to USD $2,500,000 local equivalent. Maximum limits are as follows:

- >>USD$0 – 1,500,000, 70% LTV Max Amortization 25 yrs.

- >>USD$>1,500,000 – 2,500,000, 65% LTV Max Amortization 20 years.

REQUIREMENTS FOR USD MORTGAGE LOANS ARE THE FOLLOWING:

- Copy of passport

- Copy of Driver`s License

- Copy of Social Security Card

- Complete and Sign the Application for Credit.

- Complete and Sign the FATCA Documents. (US Applicants)

- Last Two Income Tax Statements 2022 and 2023 (US Applicants)

- Authorization to issue a Credit Bureau Report from the customer’s Country of residence.

- Income Letter, if is an employee “Addressed to Scotiabank” (This letter

From your employer must confirm your hired date, current position, income

(Monthly and yearly), if you have other compensations like bonuses, housing,

- Schooling, gas and car allowances, telephone number of the human resources.

- Last 3 months of paystubs (For Salaried Applicants).

- W- 2 2022 and 2023 (US Applicants).

- Letter of Reference of your 2 primary banks (addressed to Scotiabank).

- Evidence of assets in your country of residence:

Last 3 months of Bank Statements.

Copy of the Car Deeds (Registration) 8 yrs Maximum.

Evidences of Savings (Certificates Deposits, Investments, Retirements

Savings Plan, Stocks Investments Statements).

- Copy of the property tax assessments of each property.

- Mortgage Statements.

- Evidence of the Insurance Prime of each property.

- Two Personal references of your country of residence (Full Names,

Address, Occupation, and Phone Number) these persons have to be Reachable.

- Last 3 months of credit card statements for each credit card.

- Appraisal of the property by a Bank authorized appraiser to be made in DR.

- Proof of the Down Payment

If you have questions, please don’t hesitate to contact us,

Expenses to be incurred:

- Payment of the appraisal

- Transfer of title tax equal to 3% of the value of the home.

- Administrative Expenses aScotiabank RD$7.000.00

- Attorney fees, these are provided by our attorneys based on the value and processes required for the disbursement of the loan.

- Commission of 0.15%, from the government for administration check, if the disbursement is with a check.

- Legalization of contracts.

- Payment of first installment of insurance for the property.

Remarks:

-

The loan can be up to 25 years.

You must meet larger assets or the same amount for which the loan will be made (401-k, savings, vehicles, property)

The payments of the active credits that the client has inside and outside the country, are added to the debt capacity that the client may have, and a final sum will be made including the mortgage that is requested.

The client must have the amount of the down payment of the property evidenced and the expenses incurred in the loan (tax, insurance, attorney fees)

It can take up to 30 business days for the loan to be approved.

You must have more than two years of employment record.

If you are married, your partner must sign the loan and must also send the evidence as the main applicant.

Until the client provides all the requirements, the evaluation will not be complete.

The delivery of the sales cheque is made at the time of registration of the mortgage before the Registry of Titles.